Rounding it

In the world youngsters from all over the nation happen to be Canada for every single year to pursue a top education. Each one of these pupils is burdened by the financial requirements that can wanted a mortgage if they need to make closes satisfy. Securing financing can be a perplexing process regarding the better out of products, and some around the globe people iliar to the Canadian financial landscape. Certain get ponder whether or not around the globe youngsters normally safe loans from banks and you will other styles of resource after all.

Are you presently entitled to bank loans as a worldwide college student inside the Canada? Here is all you need to find out about getting a type of credit since you seek your knowledge in the High Northern.

Scholarships and you can figuratively speaking

Of these global people seeking pay for the expense of higher education, grants and student education loans are a knowledgeable wager. Scholarships are around for of numerous Canadian people, nevertheless these usually are geared towards local students who have an excellent vastly most readily useful threat of securing him or her. Of many internationally children find one scholarships and you may educational offers is either not available on it or very tough to safer. Nonetheless, you can find of use resources you might request to understand blog post-secondary grants or apps one to international people may be entitled to. Their academic facilities pus which you can consult when shopping for scholarships and grants. Of many grants, in lieu of funds, don’t need people to blow right back what they are offered, making the most effort usually worthwhile.

Trying to personal resource oneself will be the fastest and really practical route to have money your own degree, but not. College loans out of individual loan providers is oftentimes allocated to one another instructional and you can everyday living expenses.

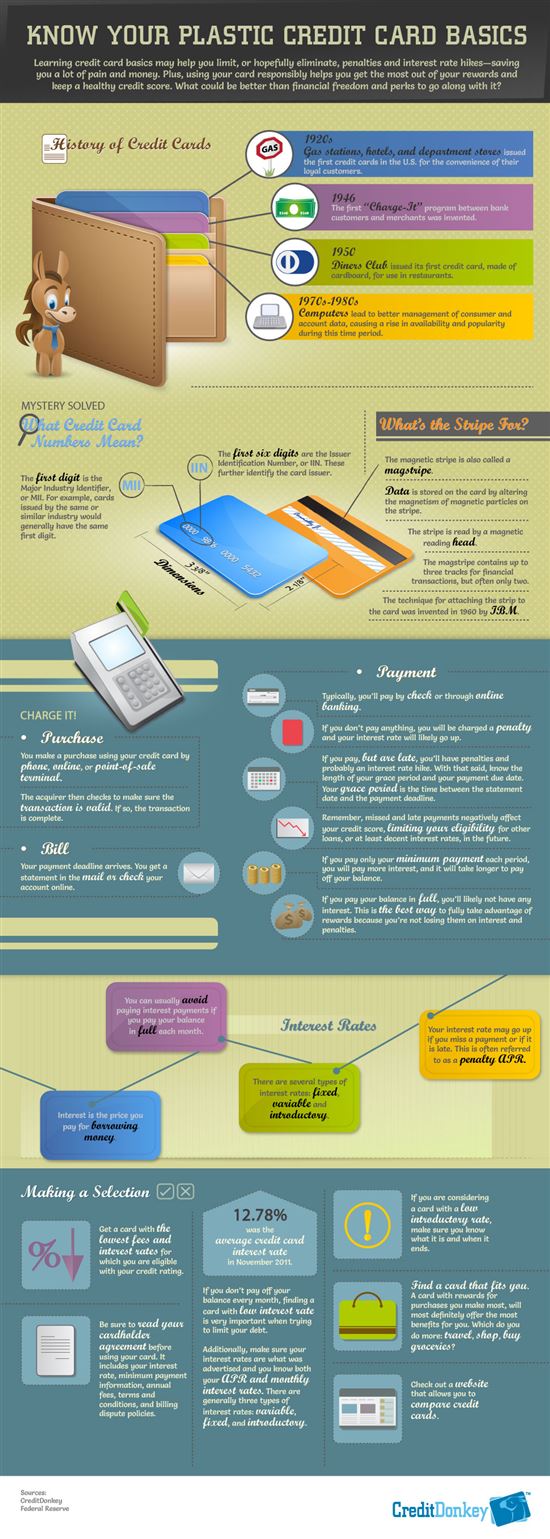

Ontario and British Columbia feel the highest number of international youngsters inside Canada, so private lenders in those places iliar toward needs out-of youngsters in terms of dispensing funds. While the IRCC (Immigration, Refugees, and you will Citizenship Canada) usually anticipate around the world college students to pay for their own degree, there are no specialized bans toward protecting an educatonal loan in purchase to do so. Youngsters should acquaint by themselves to the maxims from Canadian focus pricing in advance of seeking financing.

Imagine a personal bank loan

If you find yourself authorities fund are usually paid back once you graduate, an exclusive bank possess specific rates of interest you have to deal with once you’ve received a loan. Students who have a reliable credit history will discover personal loans are their finest wager, since you won’t want security to truly get your investment. An exceptional credit history, a highly-using business with high income, or a low debt in order to money ratio may be the merely question students has to obtain a personal bank loan to invest to possess instructions, houses, or other expenses. This type of funds makes it possible to reach the economic goals you should feel creating early in your job.

A good Canadian bank might only feel happy to promote a studies mortgage to a global college student if they have a Canadian resident co-signal the borrowed funds. Global students that have friends otherwise best friends inside the Canada will see this package is the quintessential appealing. People that don’t possess anyone to act as a great co-signer may struggle to safer education funds of individual financial institutions. Certain private businesses make it their first mission so you’re able to loan so you’re able to in the world people, nonetheless they need one data within the a certain profession (such as Stem) otherwise come from a certain area to find financing.

Getting a protected mortgage

Around the world people that simply don’t keeps a professional credit rating may still be capable of geting a bank loan. A secured mortgage need a particular investment, particularly an automobile otherwise rare old-fashioned, are arranged since security to help you have the loan. Around the world youngsters can use their secured finance for just about one monetary goal, whether it’s paying for courses, transportation, or book. It’s important to remember that failing to pay right back a safe personal loan claims which you’ll forfeit any sort of advantage you place right up once the guarantee locate it.

Around the globe Information actually reported that personal financing may function best interest levels than authorities financing within the Canada. Internationally students who are concerned with meeting their obligations is to therefore think individual types of investment before generally making a final options. Government finance are tax-deductible and offer delayed fees selection, but it doesn’t Columbus savings and installment loan be an advantage to in the world people whom pick themselves struggling to being qualified for government finance.

A valuable asset (or possessions) that can easily be arranged since the guarantee in return for brand new loan; antiques, trucks, assets, or coming paychecks could possibly get meet the requirements once the collateral

Government options for worldwide youngsters

Around the world college students might not be capable safer a loan from the Canadian government, but their very own governments home may offer some help. College students on United states that learning inside Canada s, for example. So long as you meet up with the qualification criteria, an american scholar discovering overseas in Canada (or otherwise) will see this particular government help helps them grapple which have tuition or casual will cost you off life style.

People who hope to research inside Canada eventually will be ergo consult their federal government other sites to find out if they might be eligible for federal assistance one to applies although studying overseas. Such finance might not be adequate from inside the as well as on their own, not, very believe a personal loan otherwise personal student loan in order to finance your whole costs. Housing, transport, university fees, guides, items, and private equipment like laptop computers and you can cellphones would be very costly to cover the into the a federal government federal assistance program by yourself.

Safer your upcoming in the Canada

Practically all Canadian universities usually check with worldwide youngsters just before for you personally to determine if he’s enough currency to cover the education. Certain loan providers can offer pre-entryway fund that can help your see it traditional, particularly if you enjoys a robust credit rating or reduced debt to money ratio. The amount of money you may need to fulfill which standards hinges on what your location is understanding and might even be inspired regarding what studies you are trying.

Youngsters who happen to be beginner at protecting fund will be very carefully consider the possibilities whenever evaluating individual loan providers. Certain banks and you may attributes offer a great deal more aggressive terms as opposed to others, and also you will not want being burdened with excessive rates of interest otherwise rigid installment times. Talking-to your mother and father otherwise people your believe regarding protecting a good loan from a commercial financial is an excellent starting point for young college students who’re going to begin the educational travel away from a life.